Building Multiple Income Streams in 2026:

A Sustainable Path to Financial Security Without Burnout

In an era of economic uncertainty, rising living costs, and evolving job markets, relying solely on a single paycheck is no longer a viable long-term strategy. As we enter 2026, financial experts unanimously agree: diversifying your income is one of the most powerful steps you can take toward lasting financial resilience and freedom. Wealth coaches like Halle Eavelyn emphasize that building multiple streams particularly those incorporating passive or leveraged elements provides not just additional revenue, but true security and peace of mind.

The good news? You don’t need to sacrifice your health, relationships, or well-being to achieve this. The myth that more income equals more exhaustion is outdated. Today, with accessible AI tools, automation platforms, and digital opportunities, it’s possible to create scalable systems that generate earnings with minimal ongoing effort. The wealthiest individuals aren’t working harder they’re building smarter systems that work for them.

Why Multiple Income Streams Are Essential in 2026

Financial independence isn’t about earning the most. it’s about creating options. Multiple streams reduce risk: if one source dips (due to job changes, market shifts, or unexpected events), others continue flowing. Experts note that passive income, in particular, allows your money and assets to work independently, freeing you to focus on what matters most family, personal growth, or even pursuing passions without financial pressure.

In 2026, trends like AI automation and digital platforms make this more achievable than ever. You can start small, align streams with your existing skills, and scale sustainably. The result? Greater financial confidence, reduced stress, and a balanced lifestyle that supports long-term success.

The Three Core Types of Income: Build a Balanced Foundation

To create sustainable wealth, structure your streams across three proven categories:

- Active Income: Your primary foundation typically your salary or core business. Optimize this first by negotiating raises, upskilling, or enhancing efficiency in your current role.

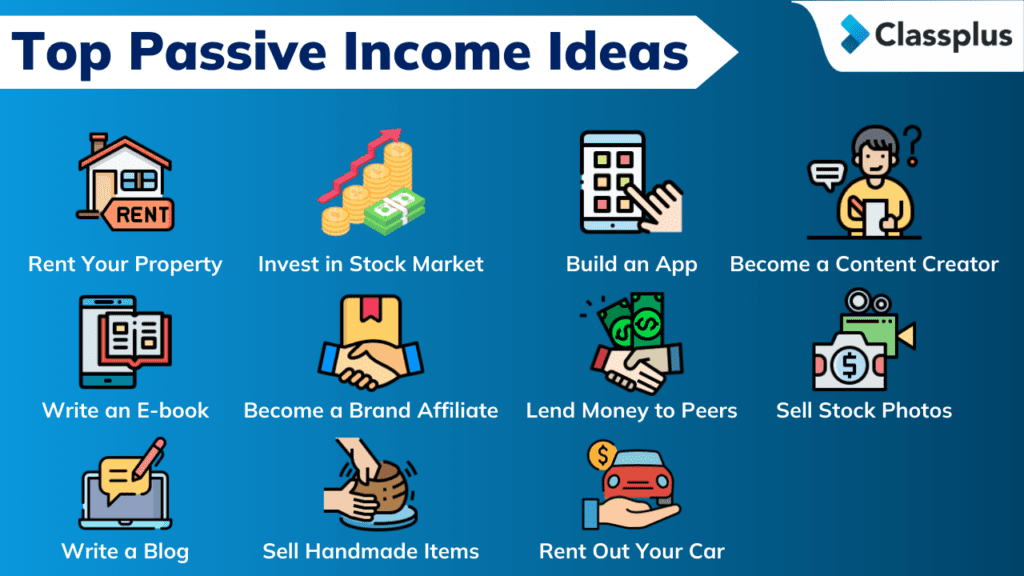

- Leveraged Income: Scalable efforts where one hour of work creates ongoing value. Examples include digital products (online courses, e-books, templates) or content creation (YouTube channels, blogs with affiliates).

- Passive Income: Earnings that require little maintenance after setup. Top ideas for 2026 include dividend stocks/ETFs, REITs, crypto staking, print-on-demand merchandise, or self-published low-content books.

By layering these, you create a robust pyramid: a stable active base, leveraged growth in the middle, and passive freedom at the top.

Proven Income Ideas for 2026: Practical and Low-Stress Options

Here are expert-recommended streams that align with current trends, requiring upfront effort but minimal daily involvement:

- Digital Products and Courses: Create once (e.g., planners, templates, or micro-courses using AI tools like Canva or ChatGPT), sell repeatedly on platforms like Etsy, Teachable, or Gumroad. Average earnings can reach thousands monthly with strong marketing.

- Print-on-Demand Merchandise: Design niche items (T-shirts, mugs) via AI, upload to Printful or Redbubble no inventory needed. Ideal for creative side earners.

- Content Creation and Affiliates: Build a blog, YouTube channel, or newsletter. Monetize through ads, sponsorships, and affiliates. AI helps with research and optimization.

- Investments: Dividend stocks, high-yield ETFs, REITs, or crypto staking for steady returns. Start with robo-advisors for ease.

- Self-Publishing: Low-content books (journals, coloring books) on Amazon KDP quick to produce with tools.

These options leverage 2026’s AI advancements, allowing you to automate workflows (e.g., Zapier for emails, Buffer for social posting) and focus on high-impact tasks.

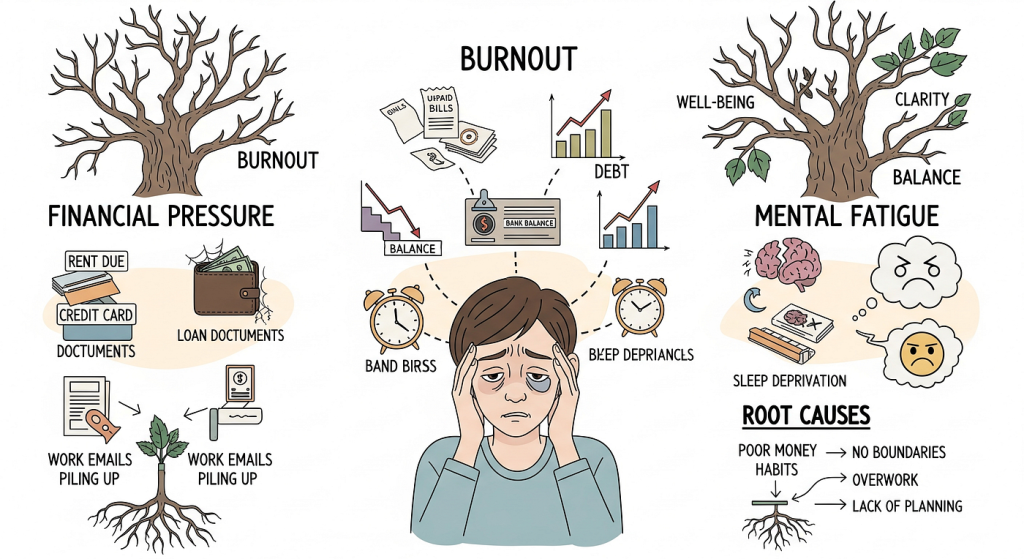

Avoiding Burnout: The Key to Long-Term Success

The greatest barrier to multiple streams isn’t lack of ideas it’s unsustainable execution. Prioritize these evidence-based strategies:

- Build Sequentially: Master one stream before adding another. Quick wins build momentum and confidence.

- Leverage Automation: Use AI for content creation, scheduling, and customer service to minimize manual work.

- Set Firm Boundaries: Limit dedicated hours (e.g., 10-15 per week) and protect personal time. Track energy levels and adjust as needed.

- Focus on Alignment: Choose streams matching your skills and interests to make the process enjoyable, not draining.

- Monitor and Review: Quarterly assessments ensure progress without overload.

This approach transforms income diversification from a grind into a liberating journey.

Your Step-by-Step Action Plan for 2026

- Assess Your Foundation: Review current finances, skills, and time availability.

- Start with One Aligned Stream: Choose a low-effort option (e.g., a digital product tied to your expertise).

- Set Up Systems: Invest in basic tools for automation and tracking.

- Launch and Iterate: Test small, gather feedback, and refine.

- Reinvest and Expand: Use earnings to fuel the next stream.

- Review Quarterly: Celebrate wins, pivot as needed, and maintain balance.

In 2026, financial security is within reach for anyone willing to think strategically. By building multiple streams thoughtfully—with automation, alignment, and self care you’re not just earning more; you’re creating freedom, resilience, and a life of greater possibility. Start today with one intentional step. Your future self will thank you.