Imagine the relief of knowing you’re keeping more of your earnings, investing in your child’s future, and setting your family up for financial success. This is your opportunity—don’t let it slip away!

- Gain instant access to expert strategies for saving on taxes in your family business by employing your children legally and effectively.

Expert-Led Insights: Our course delivers expert knowledge and practical insights, offering valuable, real-world advice for immediate application in your field.

Flexible Learning: Access your course materials anytime, anywhere, and at your own pace, allowing you to fit learning into even the busiest of schedules.

High-Quality Visuals & Production: Each video is professionally produced, ensuring engaging content that is easy to follow and visually appealing, helping to reinforce key concepts.

Cost-Effective Training: Our video courses are designed to offer high-value education at a fraction of the cost of in-person training or traditional schooling, making quality education more accessible.

TAKE ACTION NOW – THIS SPECIAL OFFER WON’T LAST!

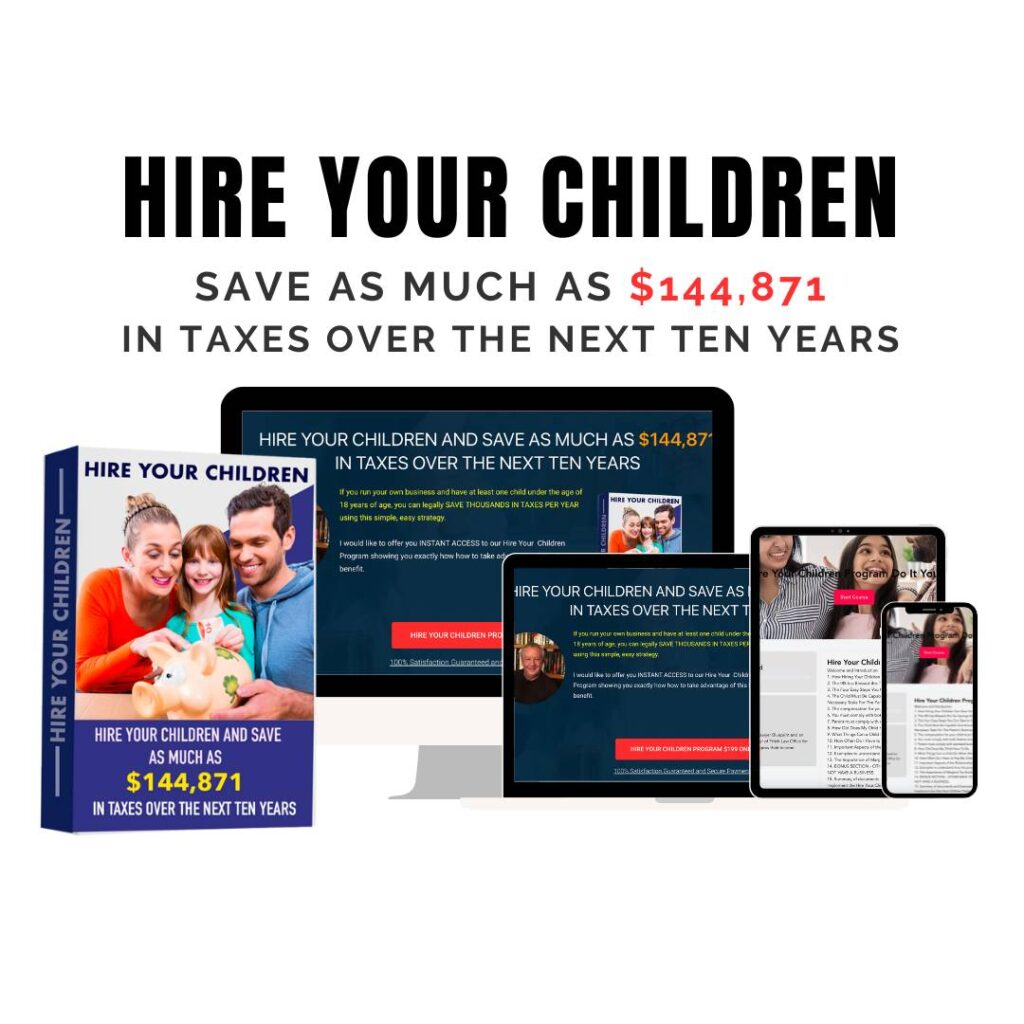

Hire Your Children Program – Only $97! 100% Satisfaction Guaranteed + Secure Payment System

Course includes written materials, quizzes, and videos.